Fraudulent Fundraising at Camp Branch Acres: A Tale of Independence and Misadventure

- Funds were not all spent on the roads, as advertised at both fundraisers. Financial transparency on ALL financial transactions involving the fundraising committe / CBASPOA is needed.

- People were misled about who they were donating to.

- Event was advertised throughout the local area as a charity event. Camp Branch Acres is not a charity, and does not meet the requirements to become a charity. Soliciting funds under the name of charity is fraud.

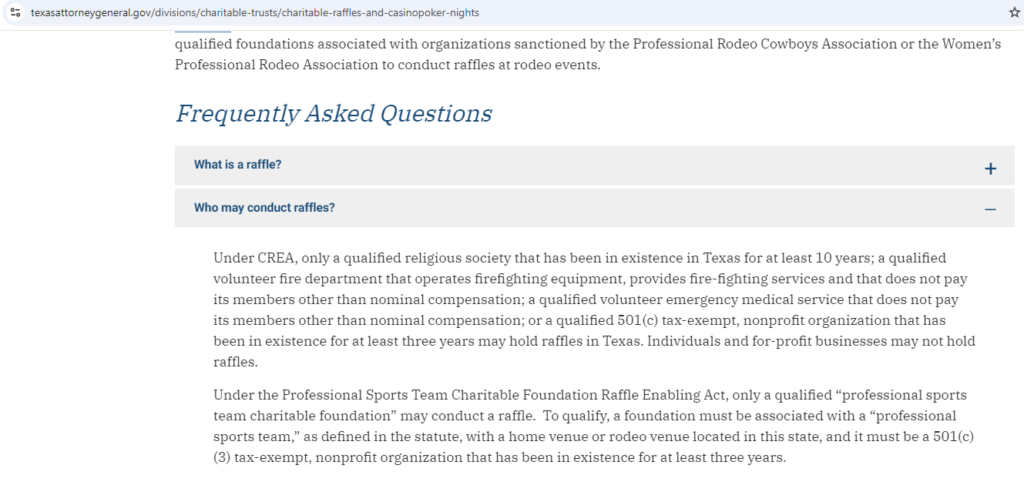

- Raffle events are considered illegal gambling when not held by qualified organizations.

In the tranquil yet treacherously pot-holed paradise of Camp Branch Acres, the annual POA meeting, cunningly masqueraded as a “charity” event, unfolded with all the drama and intrigue of a badly scripted reality TV show. Spearheaded by the notorious trio, Backtrack Paola, Kody Yawn, and Theresa Troll, the spectacle took center stage at the unsuspecting local Fire Department building.

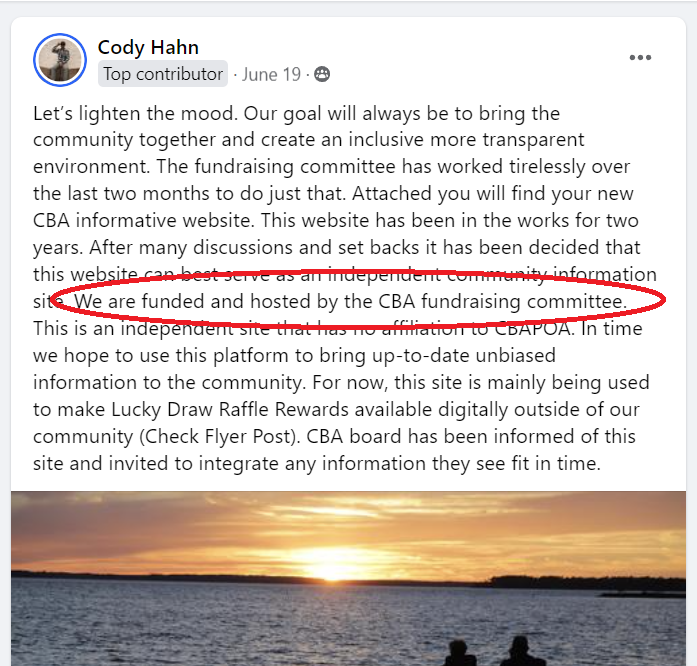

The event, saturated with the enticing aroma of philanthropy, promised attendees that “all proceeds will go to the road fund,” a noble cause if one could overlook the moon-like craters and car-swallowing canyon marking the community’s thoroughfares. However, some of these funds seemed to have embarked on a mysterious detour, ending up in the realms of “administrative expenses” and mysteriously funded websites.

Enter Kelly Feral, the once treasurer and self-proclaimed legal eagle, who boldly declared the Fundraising Committee as “independent” when questioned about the peculiar allocation of funds for Kody Yawn’s website expenses. “Ladies and gentlemen,” Kelly announced, wielding a ledger like a shield, “our Fundraising Committee exists in a sphere of sublime autonomy, unmarred by earthly ties to our POA.” To assist, Kelle Rahm declared the above statement “a typo”. Hmmmm, that’s a lot of erroneously typed letters there Kelle.

The crowd, armed with eyebrows raised high enough to challenge the laws of gravity, listened as Kody Yawn added, “Yes, my website serves as a bridge, a beacon of connection, funded through… uh, independent means.”

As murmurs filled the room, the pièce de résistance of the grand charade involved Fat Daddy’s, a local eatery of repute, which had donated a banquet under the impression they were supporting local fire heroes. When the truth surfaced—that their culinary masterpieces fueled nothing more than the POA’s potluck—discontent simmered like a forgotten stew.

Theresa Troll, ever the artist, defended the event’s creative license with a flourish, “When we said ‘fire department charity,’ we meant it’s on fire with enthusiasm for our road fund. It’s a metaphor, darling!”

Kelly, not one to miss a beat, explained the committee’s financial gymnastics with a thespian’s grace, “When I say ‘independent,’ I mean liberated from the mundane shackles of accountability and logic. It’s very quantum, you see!”

Camp Branch Acres is not a charity – raising funds at an event called a “Charity Event” by the POA/fundraising committee was fraud.

It is noteworthy that Camp Branch Acres is neither listed in the IRS’s master file of charitable exempt organizations nor is it found on Charity Navigator, casting further shadows on the legitimacy of its ‘charitable’ facade.

As the meeting adjourned, the community left pondering the real meaning of “charity” and “independence,” while dodging potholes that now seemed emblematic of the POA’s transparency—or lack thereof.

Reminder to the Wise: Being a nonprofit organization does not automatically anoint one as a charity. True charity is organized to assist others, not itself. We encourage anyone considering their donation as a tax-deductible contribution to consult their accountant first. After all, in Camp Branch Acres, the road to clarity is paved with satirical revelations and questionable accounting practices.

But Seriously Folks: Why Property Owners Associations Are Not Charities

While the antics at Camp Branch Acres might give you a good chuckle, it’s important to understand the serious distinctions between property owners associations (POAs) and charities. Here’s a breakdown of why a POA usually does not qualify as a charity under IRS standards:

Purpose: The primary purpose of a POA is to manage a residential community, which includes maintaining common areas and enforcing rules and covenants that apply to its members. These activities primarily benefit the association members themselves and are directed towards improving property values and the quality of life within the community. This is fundamentally different from the charitable purposes defined by the IRS, which are focused on activities that provide a significant public benefit.

Benefit to Members: Charitable organizations are required to serve the public good and must not provide undue benefits to private individuals. A POA, by its very nature, benefits its own members through enhanced amenities, better infrastructure, and maintained property standards. This direct benefit to private parties is a key distinction from organizations that the IRS classifies as charitable.

501(c)(3) Status: For an organization to be considered a charity, it must obtain 501(c)(3) status from the IRS. This designation is crucial as it not only confers tax-exempt status but also allows donors to write off contributions on their tax returns. POAs generally do not qualify for 501(c)(3) status because their primary activities do not align with the IRS’s criteria for charitable purposes. Camp Branch Acres is not listed in the IRS master file of tax exempt organizations. If the POA actually filed for 501(c)(3) status, we highly recommend consulting an actual tax lawyer—not Google AI, Pedantic Phil, or Facebook, Kelle.

In the curious case of Camp Branch Acres, the farcical events and questionable fundraising practices highlight the importance of understanding these distinctions. While POAs play an essential role in community management, they operate in a different sphere than charities, with different rules, objectives, and benefits.

UPDATED 09-11-2024

The Attorney General’s Site on Raffles and Poker Nights

Since we are not a charity, the raffles held at our fundraisers were illegal gambling in the State of Texas.

Leave a Reply

You must be logged in to post a comment.